What are First Time Central Heating Grants (FTCH)?

This is one of the government heating grants schemes funded by utility companies. The First Time Central Heating grants are part of the Energy Company Obligation (ECO) which is designed to help vulnerable households gain access to central heating.

To clarify, this is not a loan - it’s a grant. You won’t have to worry about paying back a penny for installing your new central heating system. Depending on the conditions and a number of factors, the grant can cover all or a large part of the cost of installing central heating in your home. Sometimes, the grant can cover the entire installation costs and even costs for repairing any plaster damage done during the installation while in other cases, households are expected to make some contribution to the costs.

It therefore lies on eligible households to compare deals presented by different ECO Approved Installers and go for the best.

The main focus of the First time central heating grants (FTCH) is to reduce fuel poverty. The idea is to move properties from electric or other less energy efficient gas heating sources in order to reduce carbon emission, thus making homes more comfortable and energy efficient.

Here are the Qualifying Criteria for First Time Central Heating Grants

1. You must be the owner of a property that has an EPC rating of D, E, F or G. If you have a higher EPC rating, you will not qualify.

2. A tenant in a private home. In this case, the eligible home must have an EPC rating of E, F or G to be eligible for Central Heating Grants.

Please note that tenants who rent their home from a housing association or a local council as well as those in shared ownership homes are not eligible.

3. Your home must have had no prior heating at all. However, if you have any of the following heating systems, you will qualify for the grant;

-

Electric room heaters, which include room heaters, fan heaters or inefficient electric storage heaters

-

Gas room heaters; including fixed mains gas room heaters;

-

Gas fire with back boiler or solid fossil fuel fire with back boiler, or

-

Mains gas warm air heating system

-

Electric underfloor or ceiling heating

-

Bottled LPG room heating; or

-

Solid fossil fuel room heaters, Wood/biomass room heating; or Oil room heaters

4. You must be in receipt of one of these qualifying benefits or alternatively, qualify under the ECO Flex Rules. You or someone living permanently with you must be a recipient of at least one of the following State Benefits, Tax Credits or Other Allowances.

-

Income Support

-

Income-Related Employment and Support Allowance (ESA)

-

Income-Based Job Seeker’s Allowance (JSA)

-

Child Benefit (subject to maximum household income)

-

Housing benefit

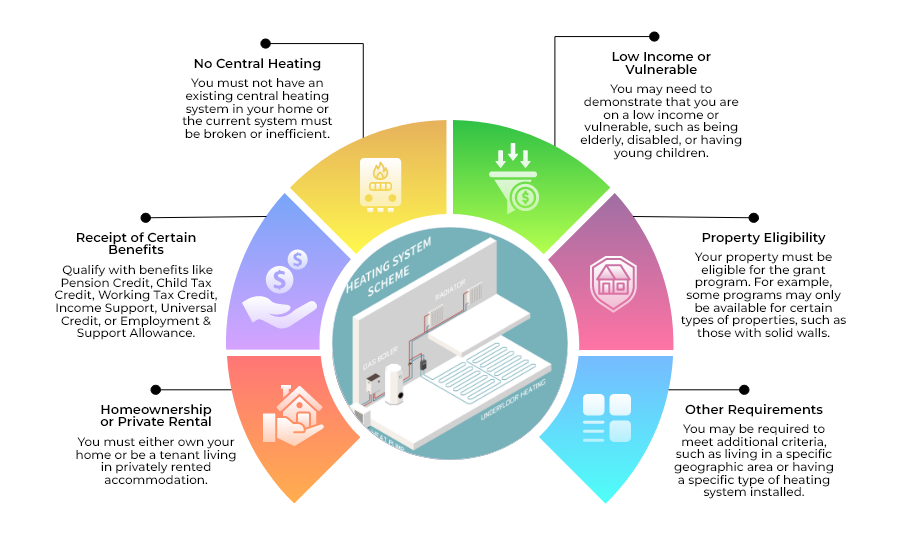

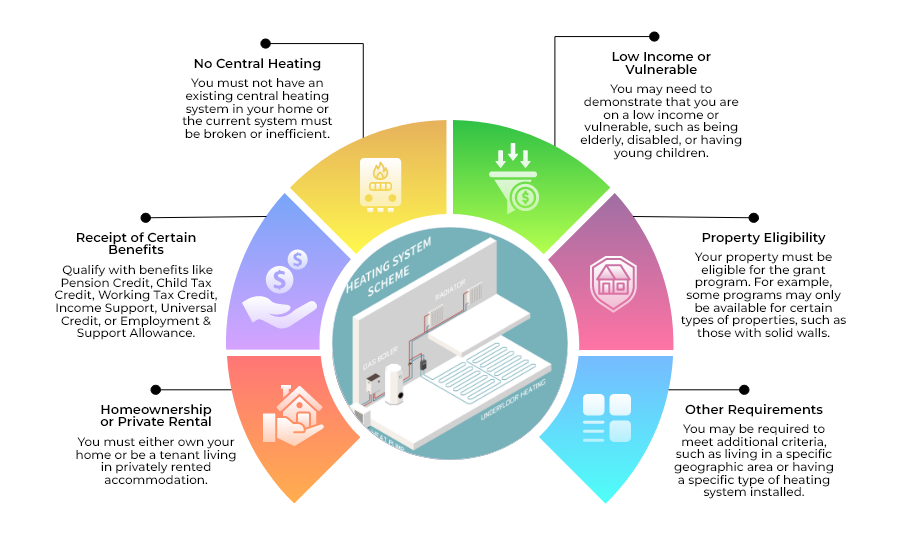

Homeownership or Private Rental: You must either own your home or be a tenant living in privately rented accommodation.

Receipt of Certain Benefits: You must receive certain benefits such as Pension Credit, Child Tax Credit, Working Tax Credit, Income Support, Universal Credit, Jobseeker’s Allowance, or Employment and Support Allowance. Eligible benefits can vary depending on the specific grant program

No Central Heating: You must not have an existing central heating system in your home or the current system must be broken or inefficient.

Low Income or Vulnerable: You may need to demonstrate that you are on a low income or vulnerable, such as being elderly, disabled, or having young children.

Property Eligibility: Your property must be eligible for the grant program. For example, some programs may only be available for certain types of properties, such as those with solid walls.

Other Requirements: You may be required to meet additional criteria, such as living in a specific geographic area or having a specific type of heating system installed.

Under the ECO Flex Rules, local councils can recommend a householder for a grant even if they are not in receipt of one of the qualifying benefits. The underlisted are four different ways whereby you can qualify under the ECO Flex Rules. Please be aware that your Local Authority has to give its approval first.

A. The income of your entire household is not up to £31,000.

B. In addition to your home having an EPC rating of E, F or G, you should be a recipient of Council Tax rebate (other than single person rebate). Additionally, you have a member who falls under one of the following categories;

-

Is allergic to living in a cold home;

-

Is referred under a Local Authority run scheme which supports low income and vulnerable households;

-

Receives free school meals or

-

Your home has been marked to be having difficulties and struggling to pay debts from utility bills and mortgage payments. Additionally, your energy supplier, mortgage lender or Citizens Advice has referred your household to the Local Authority for support.

C. You can also receive a First Time Central Heating grant under the ECO Flex Rules if the NHS has referred you to your Local Authority because your health has been significantly impacted by the cold living conditions of your home.

D. Also, Local Authorities are allowed to design their own scheme to benefit households who suffer from fuel poverty. In this case, your Local Authority would need to submit their proposals to the Government Department for Business, Energy and Industrial Strategy for approval.

5. Your home must have appropriate cavity wall insulation installed if it has cavity walls as well as adequate loft insulation.

Your installer may however arrange to have these installed for you if you do not have them prior to installing your Central heating System.

Prior to this time, homes which do not have an existing mains gas supply qualified for a First Time Central Heating Grant under the ECO3 which ended on 31st March 2022. However, under the ECO4 which started 1st April 2022, only homes which have an existing mains gas supply prior to 31st March 2022 are eligible to have a new mains gas central heating system installed in their homes.

However, if your home does not have a mains gas supply before the commencement of the ECO4, you may qualify for the installation of an air source heat pump instead, still under the First Time Central Heating grant.

What happens when someone else in my home apart from myself is in receipt of the qualifying benefits?

As we have mentioned, you can be eligible if someone who is permanently resident in your home receives one of the qualifying benefits. In this case, the application you make will have to be in their name and not in your name. Furthermore, you will have to provide proof that shows that they live with you permanently.

It is also important that your address is registered as their address with the Department of Work and Pensions. That way, their benefit letters will also have your address on them.

How much does a Full Central Heating System Cost?

On average, it will cost you between £3,500 and £7,000 to have a new central heating system installed in your home. This will include costs of pipework, radiators, boilers as well as heating controls. Sometimes you may also need a hot water storage cylinder as well as feed and expansion tanks in the loft depending on the type of boiler to be installed in your home.

Be aware that installation cost varies from one ECO installer to another. Additionally, the price of the respective elements differs from manufacturer to manufacturer.

Factors that affect the cost of a central heating system include;

-

Fuel

-

Type of boiler

-

Boiler manufacturer

-

Boiler size

In the table below is a breakdown of an estimated cost of installing a central heating system in a 3-bedroom house.

COMPONENTS |

COST RANGE |

New boiler (supply & installation) |

£1,000 - £1,500 |

9 radiators (supply & installation) |

£3,000 - £3,500 |

Water tank (supply & installation) |

£600 - £700 |

Miscellaneous parts & labour |

£150 - £200 |

Pipework (supply & installation) |

£800 - £1,000 |

Total Cost |

£5,650 - £6,900 |

You can always compare deals from different installers and choose the best for your home.